Top 9 Steps To Apply For

West Bengal Student Credit Card Scheme

Introduction

On 30th June 2021, The Government of West Bengal launched The West Bengal Student Credit Card Scheme .This scheme is designed to provide financial aid to students residing and domiciled in the state of West Bengal through a Credit Card loan.

Students pursuing secondary, higher secondary, madrasah, undergraduate, postgraduate, and doctoral studies including professional medical, engineering, and other higher education degrees within the state and outside are eligible to avail of this loan at a concessional rate of interest subject to fulfillment of certain terms and conditions.

My Blog Post Highlights the Top 9 Steps to Apply for West Bengal Student Credit Card Scheme. The Post dwells into the Salient features of this scheme including Eligibility, Documents required for Application, and other key aspects.,

Table of Contents

Student Credit Card West Bengal

On 30th June 2021, The Government of West Bengal launched The Student Credit Card Scheme. This credit card scheme is designed to enable students residing and domiciled in West Bengal to provide financial aid to pursue secondary, higher secondary, madrasah, undergraduate, postgraduate, and doctoral studies including professional medical, engineering and other higher education degrees within the state and outside by providing loans at concessional interest rates.

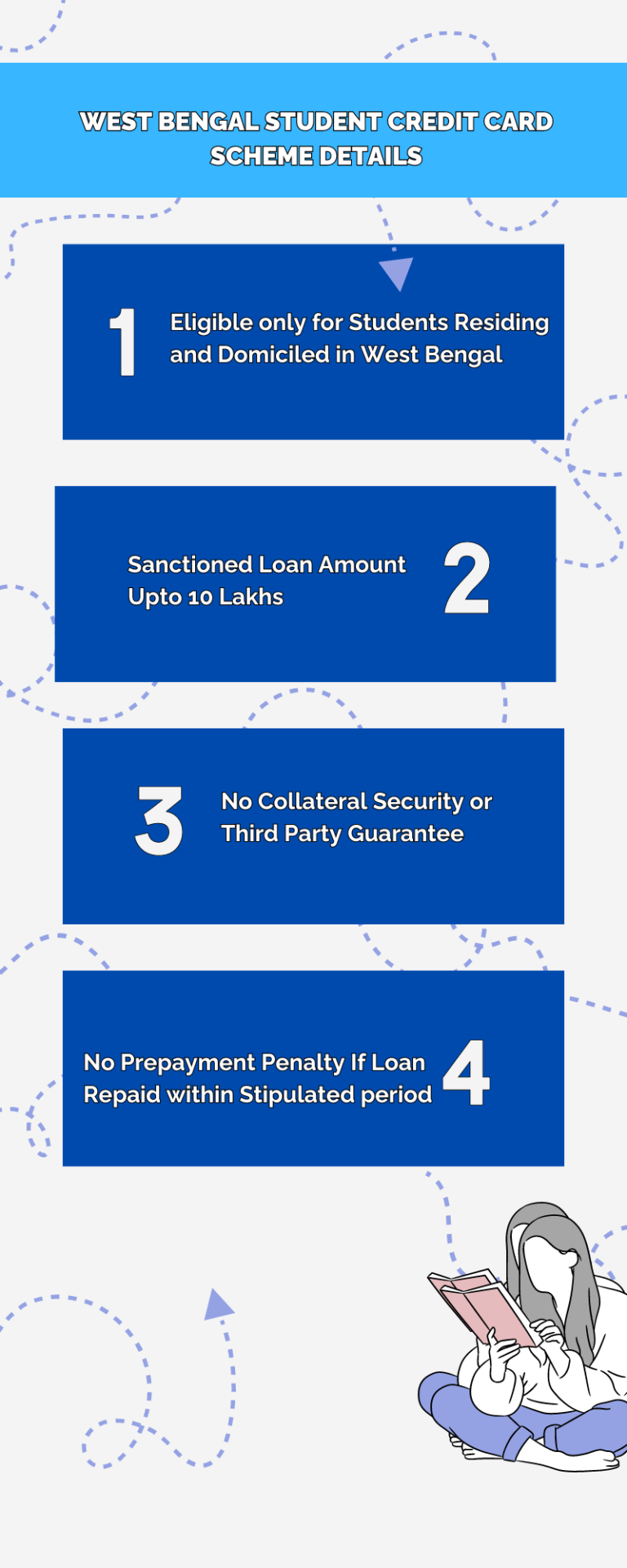

West Bengal Student Credit Card Scheme Details

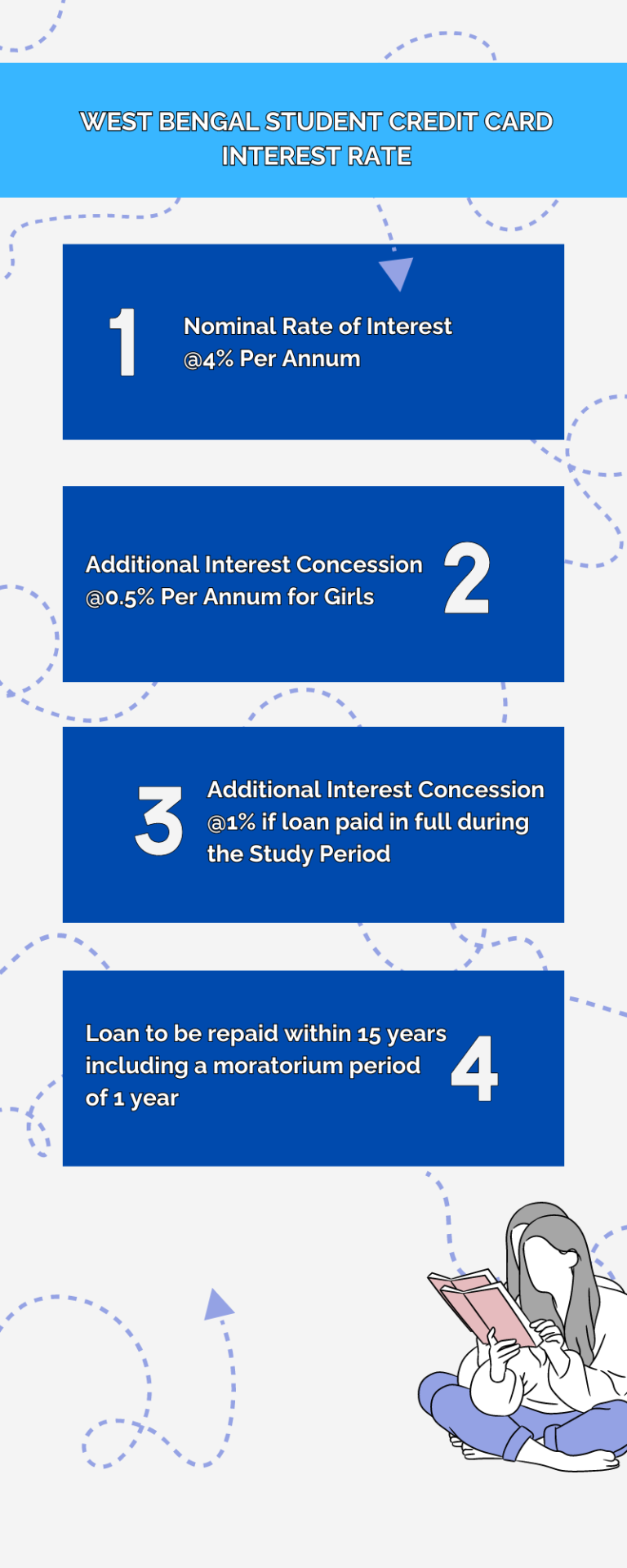

West Bengal Student Credit Card Interest Rate

West Bengal Student Credit Card Eligibility Criteria

Students must fulfill the following criteria to qualify for the West Bengal Student Credit Card Scheme.

- Student /Parents/Legal guardian should be a resident/domiciled in the state of West Bengal for a minimum period of 10 years before the date of application. Self-declaration is accepted.

- Student should complete Class IX from a recognised Board in West Bengal.

- Student should submit proof of Enrollment in higher studies/research in India or abroad in educational institutes

- The upper Age Limit of the Student must be 40 years at the time of application.

West Bengal Student Credit Card Documents Required

Students require the following documents for applying for the West Bengal Student Credit Card Scheme.

- Proof of Address (Aadhaar Card/ Ration Card/Voter ID Card)

- Pan Card of the Student (Borrower) and Parent/Legal Guardian (Co-Borrower)

- Passport size coloured photograph of the Student (Borrower) and Parent/legal guardian (Co-borrower).

- Self-declaration of Proof of Residence as per prescribed format.

- Class 10 Board registration certificate

- Details of Course Fee/Tuition fee details of the higher education/research institution where the student has enrolled for studies.

- Admission Receipt of the Higher Educational /Research Institution.

West Bengal Student Credit Card Expenses Coverage

The following expenses are covered under the West Bengal Student Credit Card scheme.

- The scheme covers Fee payable to the School/College/University /Coaching Institute/Professional Institute where the student is enrolled towards coaching for appearing in various professional entrance examinations including Medical/Law/ Engineering and various civil services examinations.

- Course Fee include tuition fees and all other fees payable towards completion of the above courses. However, Expenses and fees are payable subject to submission of the Institution’s Bills and receipts.

- Fee payable for accommodation in hostel.

- Fee payable for living outside the hostel on rent or living as Paying guest

- Expenses payable towards cost of purchasing books, Desktop Computers, Laptops and, other equipment suitable.

- Any other expense required to complete the course.

West Bengal Student Credit Card College List

More than 2000 colleges and institutions are approved in West Bengal and outside states under the West Bengal Credit Card Scheme. 900 of these colleges are located within the state of West Bengal. Rest are scattered throughout the country

These colleges and institutions offer variousundergraduate/postgraduate/doctoral and other higher education diplomas and degrees in medicine, engineering and other educational streams. Madrasah education is also provided under the scheme and a list of madrasah colleges approved under the scheme is also mentioned in the portal.

Note : A comprehensive list of affiliated colleges and educational institutions eligible under the scheme can be obtained from the West Bengal Student Credit Card website at https://wbscc.wb.gov.in

West Bengal Student Credit Card Scheme Bank List

A total of 36 banks have been authorised to process applications under the West Bengal Credit Card Scheme. Students have to download the bank forms from the respective bank sites and proceed with the application process.

Note : For more details on the Loan sanction process and other formalities of the various banks under the scheme, Students are advised to refer to the West Bengal Student Credit card portal at https://wbscc.wb.gov.in/assets/bank_user_manual.pdf

West Bengal Student Credit Card Login

Students can apply online for the West Bengal Student Credit Card Scheme by logging on to the official website at https://wbscc.wb.gov.in.

After Logging in, a student needs to follow the steps as mentioned :

- Enter the Registration option.

- Generate a unique ID and password by providing an email address and mobile number.

- This unique ID and password will be sent to the student’s mobile and needs to be used for submission of the application and all future references and queries for loan at the web portal

- Log in to your account using the credentials created.

- Fill Out the Application Form online .

- Complete the online application form with accurate and up-to-date information.

- Enter all the required details, including personal information, educational details, and financial information as required .

- Scan or photograph your supporting documents and upload them as per the specified format and size limits. Commonly required documents include an Aadhar card, bank account details, admission letter, and academic records.

- Carefully review all the information you provided in the application form and attached documents. Ensure that everything is accurate.

- Click the “Submit” or “Apply” button on the website to submit your application.

Your application will be reviewed by the relevant authorities after submission. They may contact you for additional information or verification if necessary. If your application is approved, you will receive a Student Credit Card with the specified credit limit. You will also receive information about how to use the card and repay the borrowed amount. Please stay informed about the repayment schedule and make payments on time to avoid penalties or interest charges.

Note: Students can also refer to the User Manual by logging at https://wbscc.wb.gov.in/StudentManual.pdf

West Bengal Student Credit Card Helpline Number

Students can dial the West Bengal Student Credit Card helpline number at 1800-102-8014 or mail at contactwbscc@gmail.com,support-wbscc@bangla.gov.in for any Technical support or query.

Conclusion

The West Bengal Student Credit Card Scheme has been a commendable initiative by the state government, Considering the escalating costs of higher education it can be a valuable tool for students facing financial barriers. However, every applicant should carefully consider their circumstances, re-payment capacities, and future career prospects. before taking on potential debt.

Since its inception, nearly 40% of the applications have been forwarded to banks for their approval. However, the scheme has seen limited adoption so far, with many applications being rejected. While encouraging, its effectiveness in achieving wider accessibility to education remains to be seen.

The long-term success of this scheme will depend on factors such as effective implementation, financial sustainability, and adaptability to changing circumstances and student needs.

FAQ

Where will the fund meant for institutional payment be received?

Funds sanctioned to the student under Loan for covering tuition fees, and other institutional expenses will be credited directly to the Bank account of the concerned Educational Institution.

Where will the fund meant for non-institutional expenses, including living costs, be received?

Funds sanctioned to the student under loan for covering non-institutional expenses such as living costs and purchase of study material and laptops etc will be credited to the registered bank account of the student.

Can I avail the loan for meeting the cost towards the course fee of the next academic year/semester if I can’t pass all the papers in the previous academic year/semester?

Yes, you can apply for the loan, but it must be within the ceiling of the sanctioned amount.

Is there any item-wise cap of expenditure under the loan sanctioned under the SCC scheme?

Yes, For non-institutional expenses, there is an upper ceiling on the expenditure a student can incur. It is capped up to 30% of the sanctioned loan amount under the scheme.

Can I apply for a loan under the Student’s Credit Card Scheme anytime during the course?

Yes, You can apply for a loan anytime during the course duration under the scheme.