Top 5 loan Apps

Providing Instant Loan Up To

3 lakhs

Introduction

Instant loan apps offer a convenient way to access quick funds. In this blog post, I have selected the Top 5 loan Apps providing Instant loans up to 3 lakhs. These instant loan apps allow you to apply for loans online through your smartphones and other web-based applications.

Through this blog, I will guide you through the basic steps required to obtain loans from these apps, highlighting key features, eligibility criteria, and the application process.

Table of Contents

Kreditbee Loan App

KreditBee is an online digital platform that provides short-term personal loans. It is regulated by the Reserve Bank of India. KreditBee Loans is designed to offer you quick and convenient credit access for various emergency purposes.

You can apply for a loan by downloading the Kreditbee Loan App from the Google Play store or iOS App store on your smartphones.

Kreditbee Loan - Eligibility

The Eligibility criteria for Kreditbee loans depend on the type of loan product you choose.

Some of the common eligibility requirements are :

- Age: You should be between 21 and 50 years old. This age range may vary depending on the specific loan product.

- Citizenship: You must be a citizen of India

- Employment: You need to be a salaried employee or a self-employed individual with a steady source of income

- Minimum Income: You must have a minimum monthly income to qualify for loans. The income requirement varies as per the loan product required. A minimum salary of Rs 10,000/- is required to qualify for a loan.

- Credit Score: You should have a good credit score. A credit score >650 is desirable. KreditBee offers loans based on varying credit histories. A good credit score increases chances of approval in more favourable terms.

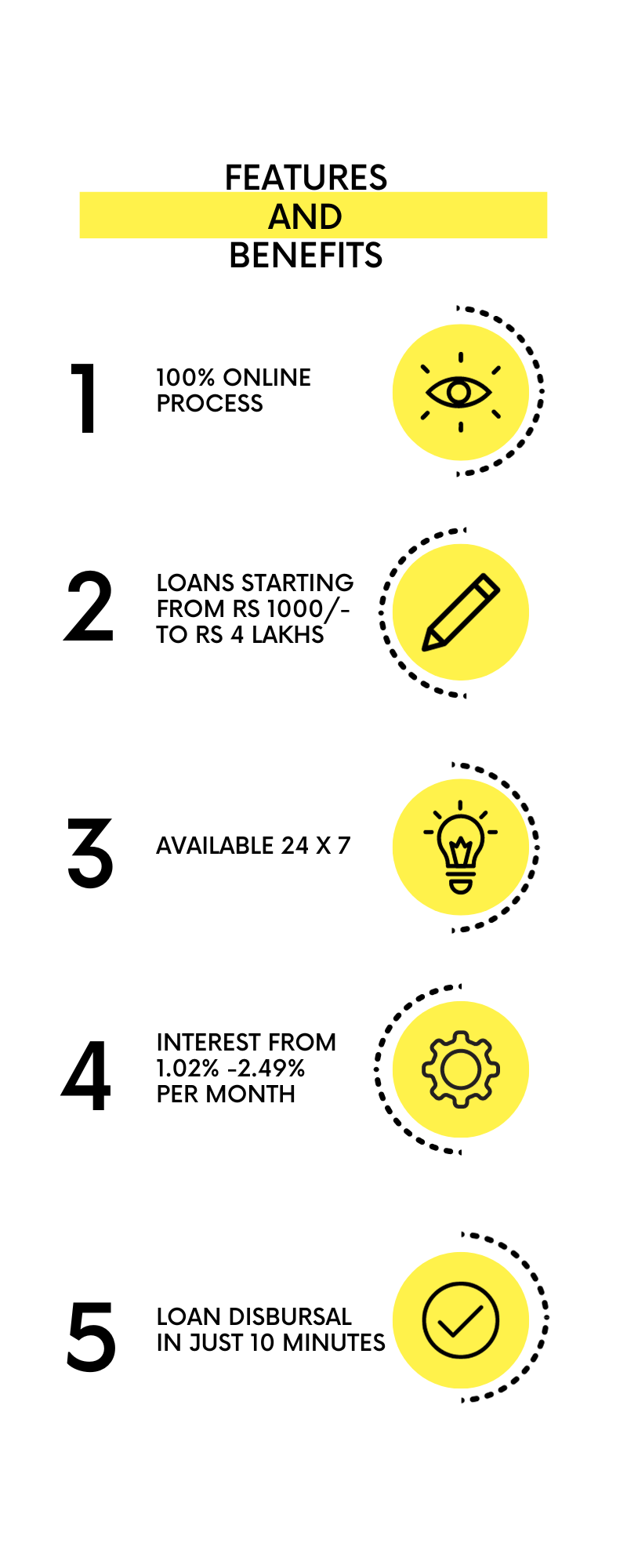

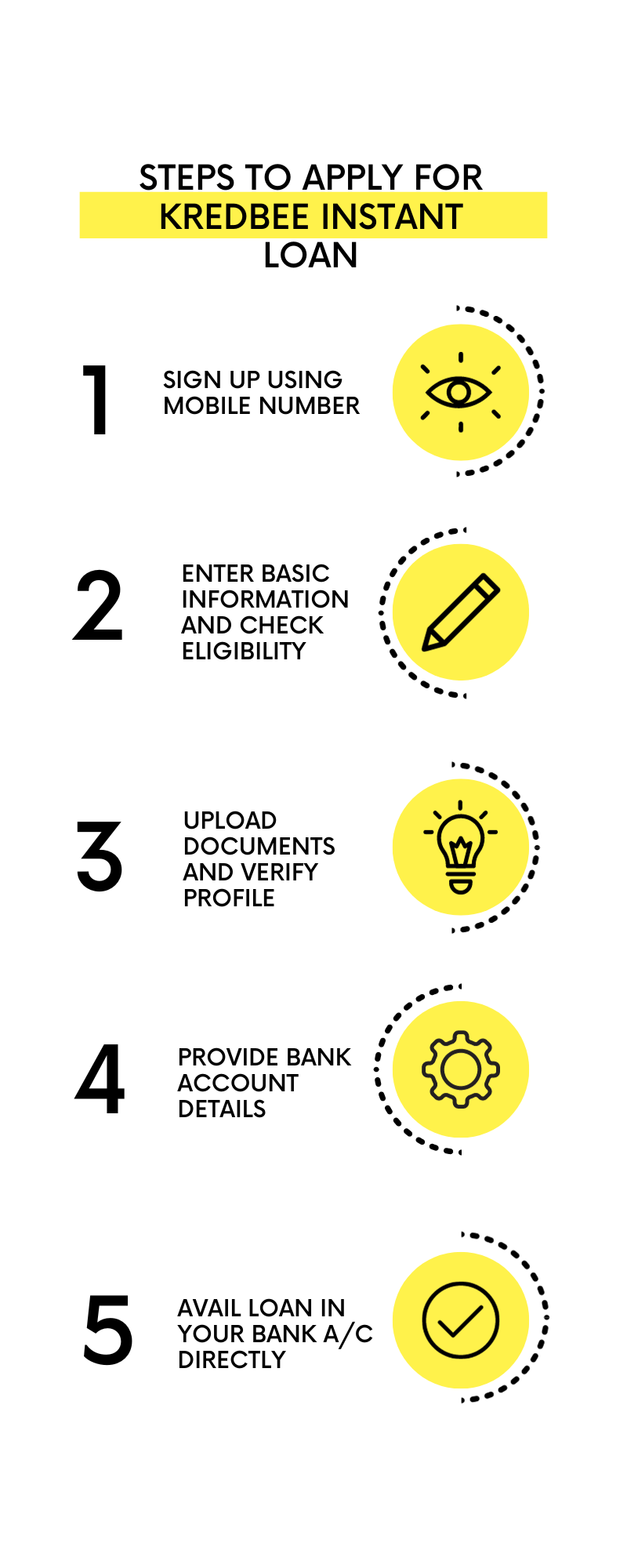

KreditBee Loan -Key Features And Application Process

IndiaLends Loan App

IndiaLends is an online digital financial technology platform that provides short-term personal loans, unsecured loans, and other financial products and services. IndiaLends is not a lender itself but acts as an intermediary between borrowers and financial institutions.

You can apply for a loan by downloading the IndiaLends Loan App from the Google Play store or iOS App store on your smartphones.

Indialends Loan Eligibility

To be eligible for an IndiaLends loan, you need to fulfill certain criteria. Some of the common eligibility requirements are :

- Age: Your age should be between 21 and 65 years old. This age range may vary depending on the specific loan product.

- Citizenship: You should be a citizen of India.

- Employment: You need to be a salaried employee ( employed in your current company for at least 6-12 months or a self-employed individual ( Business tenure for at least 3 years with 3 years ITR) to qualify for a loan.

- Minimum Income: You should have a minimum monthly income to qualify for a loan. The income requirement varies as per the loan product required. A minimum salary of Rs 10,000/- for metro cities and Rs 20,000/- for non-metro cities is required to qualify for a loan.

- Credit Score: You should have a credit score of >750. Applicants are offered loans based on varying credit histories. However, a good credit score increases your chances of approval in more favourable terms.

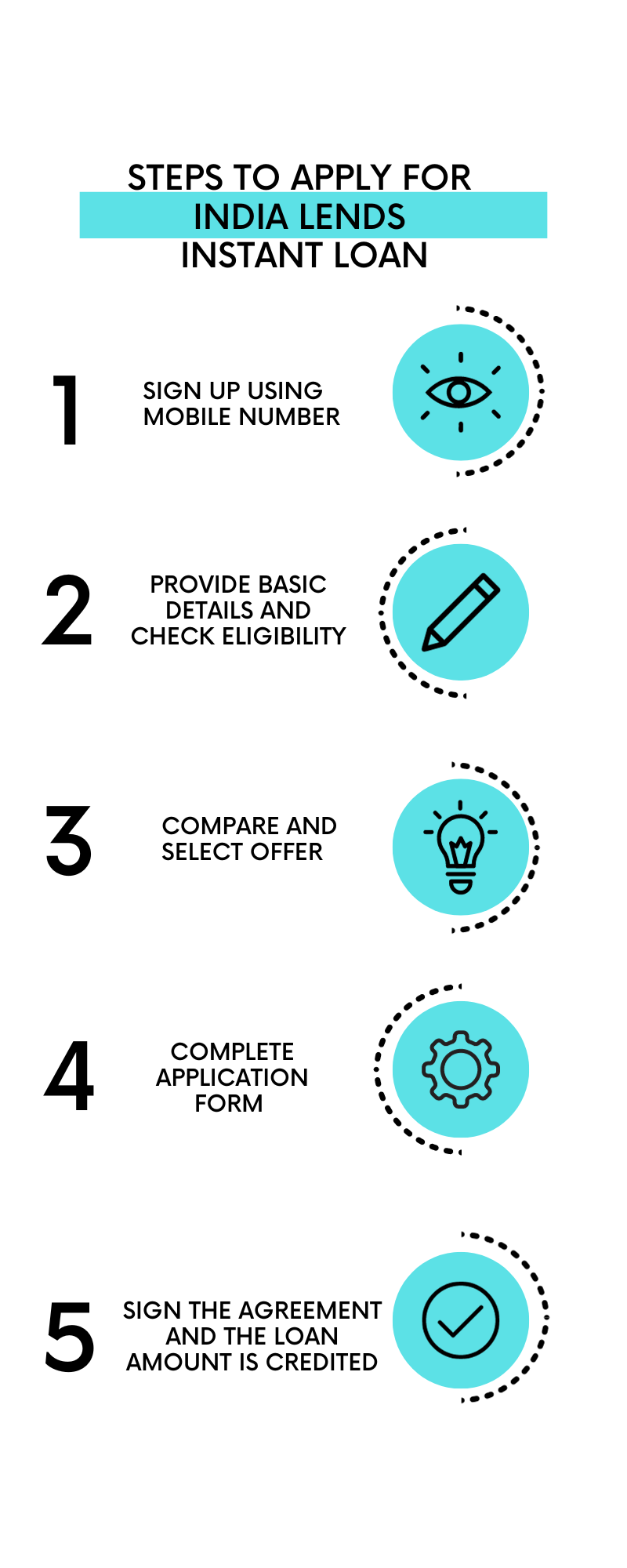

IndiaLends Loan Key Features And Application Process

PaySense Loan App

PaySense is one of India’s leading online digital platforms that provides short-term loans to individuals with Flexi EMI Options, zero collaterals, and affordable interest rates. It is regulated by the Reserve Bank of India.

You can apply for a loan by downloading the Paysense Loan App from the Google Play store or iOS App store on your smartphone.

PaySense Loan Eligibility

Your eligibility criteria for PaySense loans depends on the specific type of loan product chosen. Some of the the common requirements are :

- Age: You should be between 21 and 60 years old. This age range may vary depending on the specific loan product.

- Citizenship: You should be a citizen of India.

- Minimum Income: You require a minimum monthly income to qualify for loans. The income requirement varies as per the required loan product. If you are a salaried individual, your Minimum monthly salary should be Rs 12,000/-. For self-employed a minimum income should be Rs 15,000/- to apply for a loan.

- Proof of Identity: You must have an Aadhar Card, Voter ID Card, and Pan Card as Proof of Identity and Address.

- Credit Score: Applicants are offered loans based on varying credit histories. You should have a good credit score of 700 and above. Good credit scores increases the chances of approval in more favourable terms

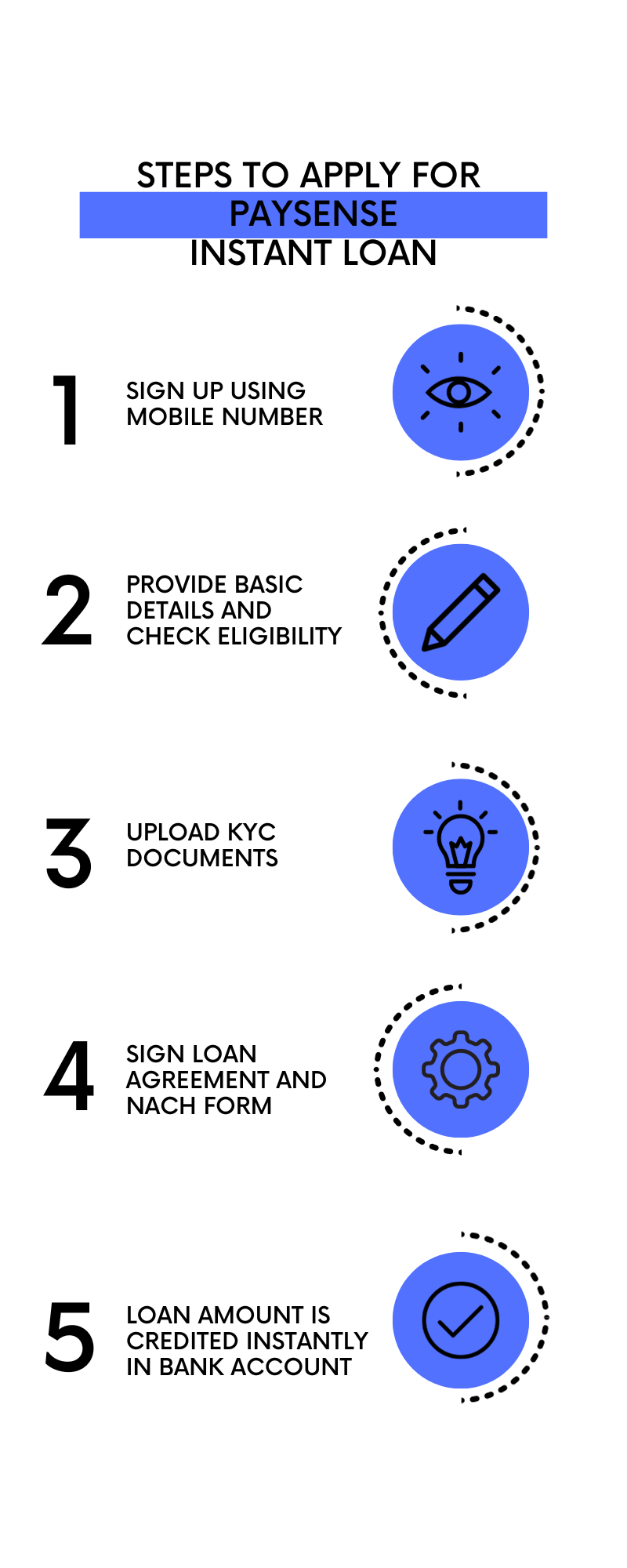

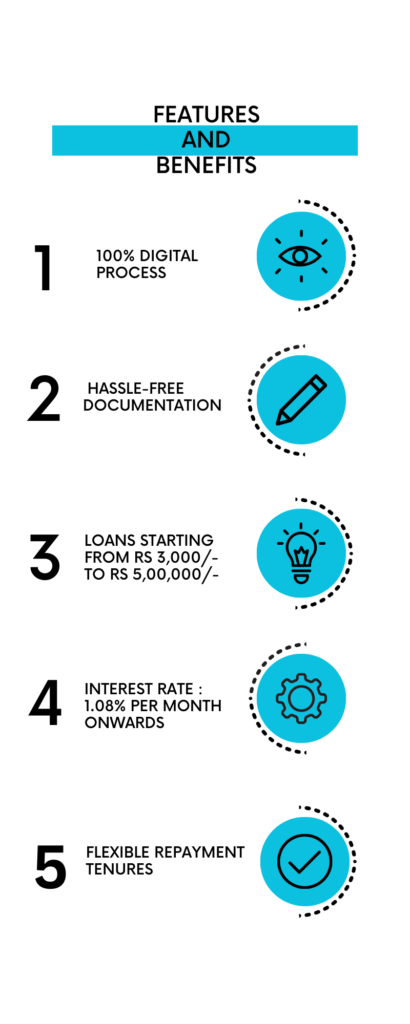

PaySense Loan -Key Features And Application Process

MoneyTap Loan App

MoneyTap is an instant personal loan App in India that offers you instant loans. It simplifies the process by giving you your own personal credit line, ready to be used anytime from anywhere. It is extremely fast, secure, and totally digital.

You can apply for a loan by downloading the MoneyTap Loan App from the Google Play store or iOS App store on your smartphones.

MoneyTap Loan Eligibility

MoneyTap has specific criteria to determine whether you are eligible for a personal loan. Some of the common eligibility requirements are :

- Age: You should be between 23 and 55 years old. This age range may vary depending on the specific loan product

- Citizenship: You should be a citizen of India.

- Employment: If you are a Salaried employee then you should have a minimum of 2 years of work experience and at least 6 months with the current employer. If you are a self-employed professional then a minimum of 3 years in business is required. MoneyTap needs you to have a steady source of income to qualify for loans.

- Minimum income: You require a minimum income of Rs. 30,000 per month (for both salaried and self-employed )

- Credit Score: You should ideally have a credit score of 750 or above for the best loan terms. However, MoneyTap may consider applications with lower scores on a case-by-case basis. Applicants are offered loans based on varying credit histories.

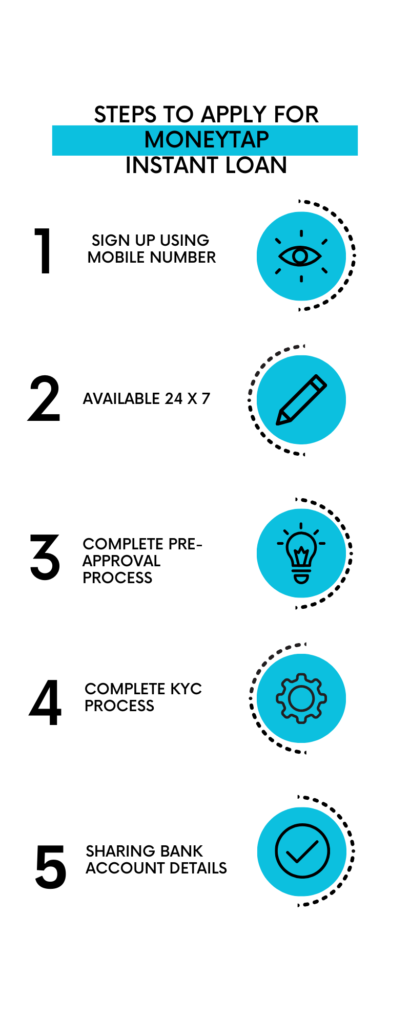

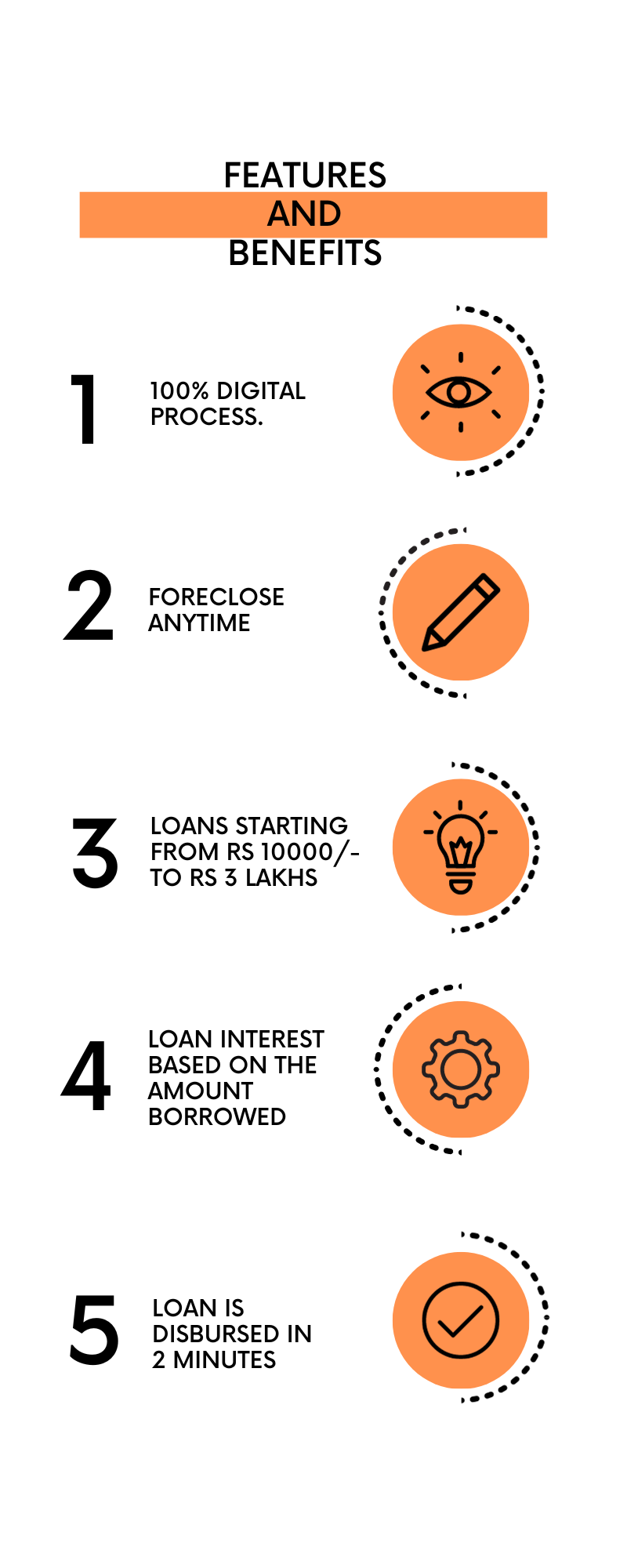

MoneyTap Loan Key Features And Application Process

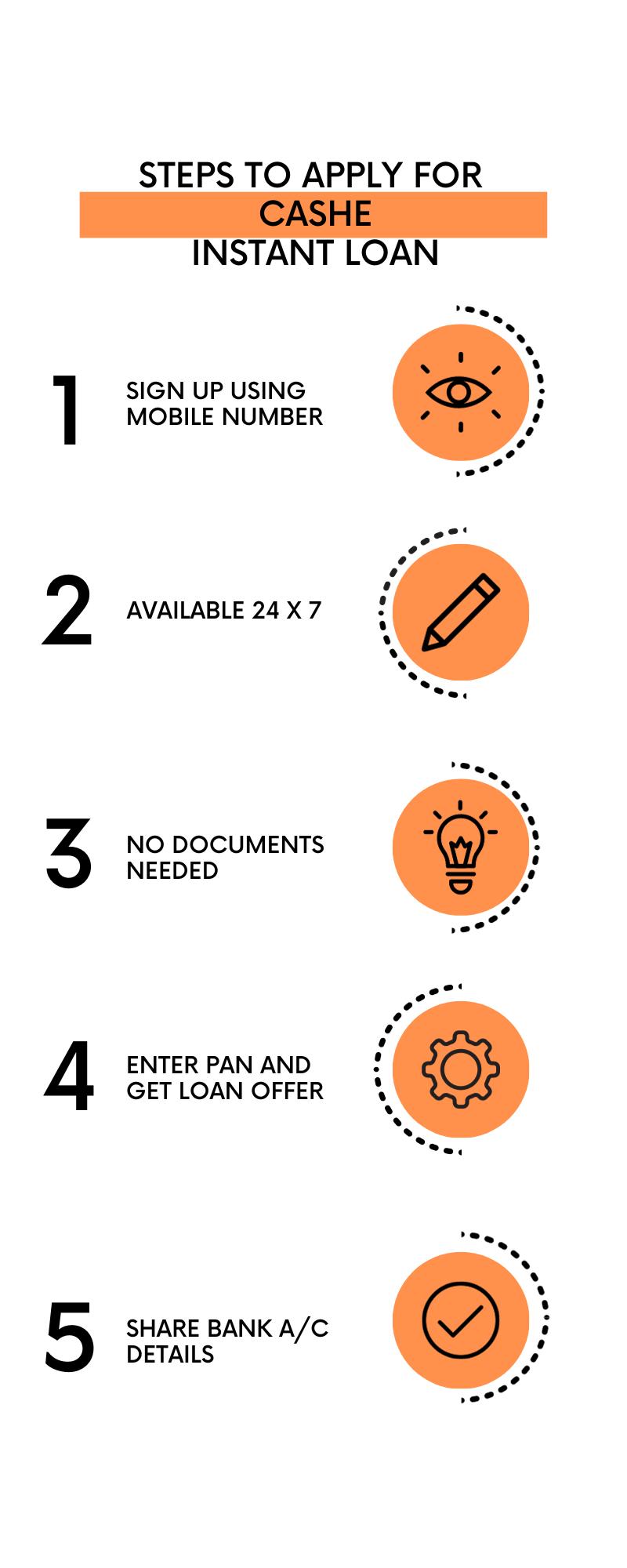

CASHe Loan App

CASHe is a lending app that offers instant personal loans without security or collateral. They can be used for any purpose, including gadget purchases, weddings, holidays, medical emergencies, etc.

You can apply for a loan by downloading the CASHe Loan App from the Google Play store or iOS App store on your smartphones

CASHe Loan Eligibility

To be eligible for a CASHe personal loan, you’ll need to meet the following criteria:

- Age: You should be between 18 and 58 years old.

- Citizenship: You should be a citizen of India.

- Employment: You need to submit proof of income and employment. Your income should be a minimum of Rs 12,000 or above.

- Credit Score: Applicants are offered loans based on varying credit histories. However, a good credit score of 750 or above increases the chances of approval in more favorable terms

- Proof Of Identity: Applicants must possess an Aadhar Card, Voter ID Card, and PAN Card for submission and verification.

CASHe Loan Key Features And Application Process

Conclusion

In conclusion, instant loans can be a helpful solution if you’re facing unexpected expenses, such as medical bills or educational fees, and find yourself short on funds. It can be a useful financial tool if you use the amount judiciously. Make sure that you choose a reliable lender by thoroughly researching the app’s reputation. Consider applying for loans only through an app that has a positive review and a large user base.

Always be a responsible borrower. Evaluate your financial needs, choose a reliable lender, and use instant loans wisely.

FAQ

Which documents are required for taking an instant loan

To apply for an instant loan, you need to submit the following documents .

- PAN card copy

- AADHAAR card copy

- Government-issued ID card

- 3 months’ bank account statement

- Latest electricity/telephone/credit card bill

- Valid passport or house lease agreement

What is the average interest rate for instant loan ?

The average interest rates for instant loans can vary based on the your loan type, and creditworthiness. It typically ranges from 10.25% to 29.95% depending on the loan tenure. APR ( Annual Percentage Rate ) varies from 25% to 30% on an average.

How do I calculate my EMI for an instant loan?

How important is your credit score?

Your credit score plays a crucial role in faster disbursal. A good credit score enhances your chances of loan approval and favorable terms

What is the difference between a secured and unsecured loan?

Secured Loans: Secured loans are backed by collateral, which means you must provide an asset (such as a home, car, or savings account) as security for repayment. If you fail to make payments, the lender can seize the collateral to recover their funds.

Unsecured Loans: Unsecured loans do not require collateral. You don’t need to pledge any specific asset. Since there’s no collateral, lenders face a higher risk. As a result, unsecured loans often have stricter credit requirements.

Note : All Personal Loans are Unsecured Loans.