Top 9 FAQs for Travel Insurance

for Dubai from India

Introduction

Welcome to the gateway of luxury, adventure, and culture—Dubai! As you plan your escapade from India to the dazzling landscapes and modern wonders of this Middle Eastern gem, there’s one essential element that deserves your utmost attention: travel insurance.Travel Insurance is necessary to travel to Dubai from India.

In this blog post, I have mentioned the Top 9 FAQs for Travel Insurance for Dubai from India. Through these FAQs, I will delve into the vital realm of travel insurance tailored specifically for your sojourn from India to Dubai.

Table of Contents

Is it Mandatory to have Travel Insurance for Dubai from India ?

Travel insurance for Dubai from India is not mandatory if you don’t need a visa to enter the United Arab Emirates (which includes Dubai). However, if you plan to apply for a UAE visa, you must show proof of having obtained travel insurance in the Dubai plan. Travel insurance protects you from unexpected expenses due to medical emergencies, trip disruptions, loss of belongings, and other unforeseen circumstances.

Travel Insurance for Dubai from India Cost ?

Cost of insurance refers to the premium you have to pay to your insurance provider for taking policy coverage. The Cost of Travel insurance for Dubai from India can vary widely based on several factors:

Note :

- It is always advisable to compare quotes from different insurance providers to find yourself most suitable coverage at a competitive price.

- Some websites allow you to compare multiple insurance plans based on coverage and cost, simplifying the decision-making process.

- Your Insurance premiums can significantly vary based on individual circumstances, insurance providers, specific policy features, and any ongoing promotions or discounts.

- Your Insurance Premiums typically costs around 4-10% of the total trip cost.

What is Covered under Travel Insurance for Dubai from India?

Travel insurance for Dubai from India typically covers a range of aspects, but the specific coverage can vary depending on the insurance provider and the chosen plan. Here are the common elements covered by travel insurance for Dubai from India:

Medical Coverage:

- Emergency Medical Expenses: This covers costs relating to sudden illnesses, injuries, or accidents during your trip. It also includes hospitalization, surgeries, medications, and doctor consultations.

- Medical Evacuation: This covers the cost of providing your transportation to the nearest suitable medical facility or repatriation to India in case of severe medical emergencies.

Trip-related Coverage:

- Trip Cancellation/Interruption: This coverage reimburses non-refundable trip costs if your trip to Dubai is canceled or interrupted due to covered reasons like illness, injury, or specific unforeseen events.

- Delay/Cancellation of Flights: This coverage reimburses additional expenses incurred by you due to flight delays or cancellations, such as accommodation and meals.

Baggage and Personal Belongings:

- Baggage Loss/Damage: This coverage reimburses for lost, stolen, or damaged baggage during your trip.

- Delayed Baggage: This coverage reimburses for essential items purchased by you due to delayed baggage arrival.

Personal Liability:

- Third-Party Liability: This coverage reimburses for legal expenses and compensation in case you are held legally responsible for causing injury or property damage to someone else.

Additional Coverages (can vary):

- Adventure Sports Coverage: This coverage reimburses for injuries sustained if any by you during specific adventurous activities, like skiing or scuba diving, if included in the policy.

- Emergency Dental Treatment: This coverage reimburses your dental emergencies during the trip.

- Document Loss: This coverage provides you assistance and reimbursement for lost or stolen travel documents like passports or visas.

- Emergency Assistance Services: This provides you access to 24/7 helplines for emergencies or advice during the trip.

- Repatriation of Remains: This covers costs for returning remains to India in case you are involved in a fatal incident.

What is not Covered under Travel Insurance for Dubai from India ?

Travel insurance for Dubai from India typically includes coverage for various situations, but there are several common exclusions. These exclusions can vary based on the insurance provider and the specific policy. Here are some typical scenarios that might not be covered by your policy:

Pre-Existing Medical Conditions:

- Treatment for Pre-Existing Conditions: If you have any pre-existing medical condition before purchasing a travel insurance policy then your policy might not provide you coverage for such medical conditions.

High-Risk Activities:

- Extreme Sports and Hazardous Activities: If you sustain any injury while participating in activities such as skydiving, bungee jumping, or certain adventure sports then such incidents are not covered by standard travel insurance policies.

Illegal or Reckless Behavior:

- Engaging in Illegal Activities: Any involvement in illegal or unlawful acts during your trip resulting in losses are not covered.

Intoxication or Substance Abuse:

- Injuries Due to Alcohol or Drug Use: Any incidents or accidents occurring while you are under the influence of alcohol or non-prescription drugs might not be covered.

Failure to Follow Advice or Negligence:

- Ignoring Travel Advisories: If you travel to areas for which government authorities have issued warnings or advisories or to conflict zones and such travels result in losses then your policy might not cover these expenses.

- Negligence: Instances where your negligence contributes to the loss or incident (like leaving belongings unattended) might not be covered.

Delayed Documentation and Visa Issues:

- Late Visa Procurement: Issues related to delays in obtaining necessary visas or documents required for travel.

- Travel without Proper Documentation: Problems arising from traveling without the required documentation or visas.

Note :

- You should always review the policy details to ensure that it aligns with your travel plans and needs.

- Please study the policy wording, coverage limits, terms, and exclusions in detail before purchasing travel insurance to understand what is covered and what isn’t. If uncertain, contact your insurance provider for clarification.

What is the duration of Coverage of Travel Insurance for Dubai from India ?

The duration of travel insurance policy coverage can differ among insurance providers, so it IS essential to review and choose a policy that aligns with the length of your trip to Dubai from India.

Insurance providers consider the following points when deciding on your policy duratioN.

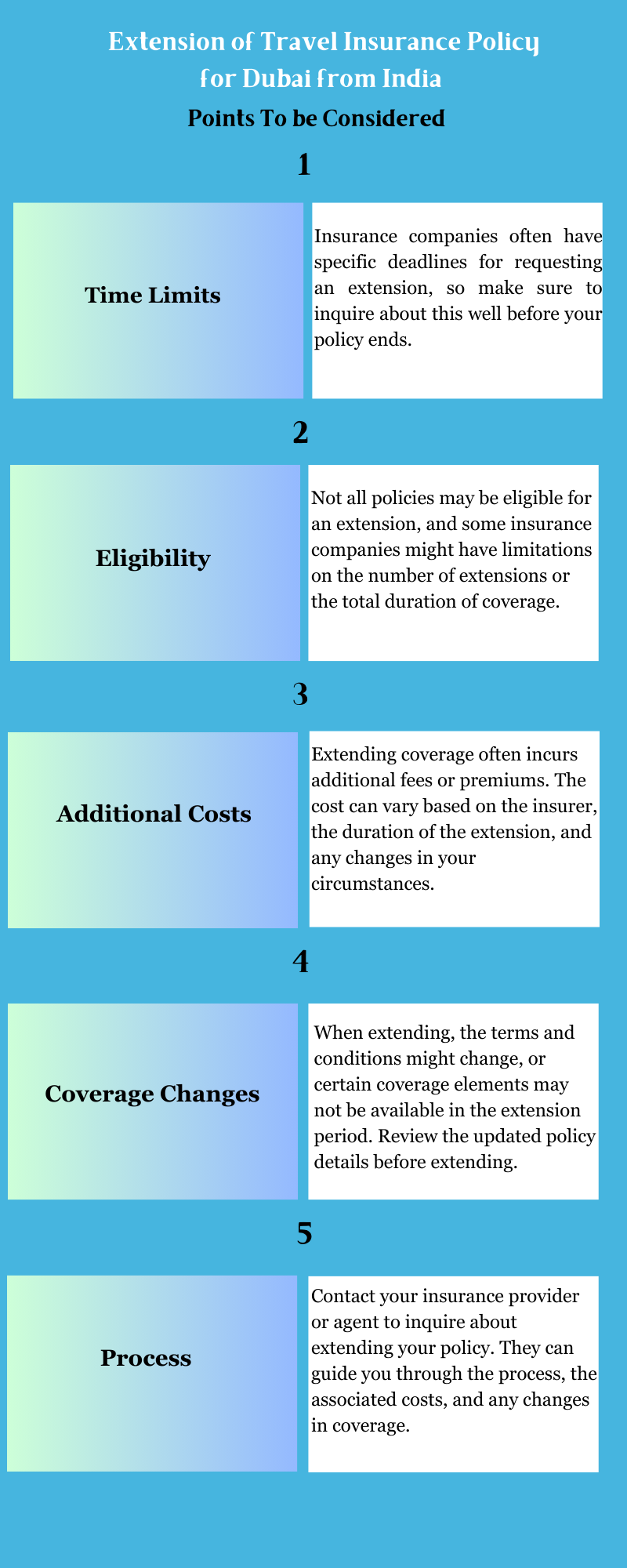

Can I Extend my Policy of Travel Insurance for Dubai from India?

Yes, You can extend the duration of coverage of your policy of Travel Insurance for Dubai from India.. Many travel insurance policies offer the option to extend coverage, but it’s crucial to note that extensions usually need to be requested before the initial policy expires and before any incidents or claims occur. The extension duration and terms can vary between insurance providers.

Here’s what you might need to consider when extending your travel insurance policy:

What is the Process for making a claim while in Dubai?

The process of making a claim for travel insurance for Dubai from India generally involves the following steps:

Here’s a general guide:

- Keep Your Documentation: You are advised to collect and keep all relevant documents such as your insurance policy details, receipts, medical reports (if applicable), police reports (in case of theft), and any other evidence related to the claim.

- Notify the Insurance Provider: You are advised to contact your insurance company as soon as possible after the incident or event that requires a claim. Most insurers have a helpline or a dedicated claims department for assistance. They will guide you through the process and may provide claim forms that you need to fill out.

- Complete Claim Forms: You need to fill out the necessary claim forms accurately and thoroughly. Please Ensure that all information provided is correct and supported by the required documentation. Submit these forms along with the supporting documents requested by the insurer.

- Submit Documents: Send the copies of the your documents to the insurance company as per their instructions. This might include proof of travel, medical bills, police reports, receipts for expenses, etc.

- Cooperate with Investigations: In certain cases, the insurer might conduct an investigation, especially for when you make a significant claim. In such cases, you need to cooperate fully with their inquiries and provide any additional information they request.

- Follow-Up: Always Stay in touch with your insurance company for updates on your claim’s status. They might require additional information or documentation during the processing period.

- Claim Settlement: Once your claim is approved, the insurance company will provide compensation according to the terms of your policy.

Note : Please remember to always refer to your specific insurance policy documents for detailed information on the claims process, including what is covered, claim procedures, contact information, and any specific requirements or limitations for making a claim while traveling to Dubai from India.

Which is the Best Travel Insurance for Dubai from India

Several reputable travel insurance companies in India offer coverage for trips to Dubai. Determining the “best” company for Travel insurance for Dubai from India can vary based on individual needs, preferences, and the specific coverage required.

Some prominent insurance companies offering travel insurance for Dubai from India are :

ICICI Lombard General Insurance Company: They offer comprehensive travel insurance plans with extensive coverage options for various aspects like medical emergencies, trip cancellations, baggage loss, etc. For more details on their specific Dubai plans, you can access their Website at :https://www.icicilombard.com/campaigns/travel-insurance/dubai-travel-insurance .

HDFC ERGO General Insurance: They offer comprehensive travel insurance plans covering medical expenses, trip cancellations, loss of baggage, and more. They also offer plans tailored for different types of travelers. For more details on their specific Dubai plans, you can access their website at https://www.hdfcergo.com/travel-insurance/dubai for more details.

Reliance General Insurance: They provide various travel insurance plans covering medical emergencies, personal accidents, loss of baggage, and more. They have customizable options for different travel needs. For more details on their specific Dubai plans you can access their website at https://www.reliancegeneral.co.in/insurance/travel-insurance/overseas-travel-insurance/middle-east-travel-insurance.aspx for more details.

TATA AIG General Insurance: They offer a range of travel insurance plans with comprehensive coverage for medical emergencies, trip cancellations, baggage loss, etc. Please log on to their website at https://www.tataaig.com/travel-insurance/travel-insurance-dubai for more details.

Bajaj Allianz General Insurance: They are known for its travel insurance plans covering various aspects of travel, including medical emergencies, trip interruptions, and loss of baggage. Please log on to their website at https://www.bajajallianz.com/travel-insurance-online/travel-insurance-dubai.html for more details.

Note : When choosing the best travel insurance company, you need to consider the factors such as your Coverage needs, Policy Limits and exclusions, customer reviews and ratings etc. Also, compare the premiums to be paid among different insurers to get the best value in terms of benefits and coverage

Important Information On Dubai

| Category | Description |

|---|---|

| Country | United Arab Emirates (UAE) |

| Currency | Dirham |

| Exchange Rate | 1 Dirham=22.57 Indian Rupee , 1 Dirham =0.27 USD |

| Official Language | Arabic |

| Languages Spoken | English, Hindi, Gujrati, Malyalam |

| International Airport | Dubai International Airport |

| Time Zone | GMT +4 |

| For more Basic information Log in at | https://www.britannica.com/place/Dubai-emirate-United-Arab-Emirates |

Conclusion

As you prepare to travel to the city of Dubai, the significance of travel insurance cannot be overstated. It serves as your guardian angel, offering a safety net against the unforeseen, ensuring your journey remains a cherished dream rather than an unexpected disruption.

In every adventure lies an element of uncertainty. Travel insurance emerges as your trusted companion, offering a shield against the unexpected, allowing you to embrace the emirate’s wonders with confidence. From medical emergencies to flight cancellations, lost baggage, or need for sudden evacuation, travel insurance stands as a beacon of reassurance, assuring you that even in familiar terrain, you are safeguarded.

FAQ

Is Travel Insurance mandatory for Dubai from India ?

Dubai requires mandatory travel insurance for visitors, highlighting the importance of being insured while travelling to the city.

How much is travel insurance to Dubai from India

Basic Travel insurance plans for Dubai from India are affordable in the range of ₹40.0 to ₹49.0 per day for a five day term.

Is Healthcare free in Dubai for tourists?

Tourists are not legally required to have private health insurance in Dubai. Private healthcare may still be available to globetrotters if they have travel insurance that covers medical expenses. Otherwise, you must solely pay for it out of your pocket.

Is Dubai visa free for Indians?

No, Dubai visa for Indians is not free. There is a nominal Dubai visa cost that you have to pay while filling your Dubai visa application form.

How much bank balance is required for Dubai tourist visa?

A bank statement of the last six months with a minimum balance of $4,000 or approx INR 333000 based on the current conversion rate. You must also provide a local UAE address, local landline number, and mobile number. Indian applications undergo scrutiny and extensive review because it is a UAE multiple-entry visa.

Can I get Dubai visa on arrival?

Yes, there is a visa on arrival in Dubai (UAE) for Indian citizens and is valid for 14 days. However, it can be extended only once for an additional time period of 14 days and is only valid for Indian passport holders with a valid US visa.

Can I add insurance after booking flight?

The short answer is: It’s not too late! You absolutely can buy travel insurance after booking your trip. However, it’s always best to purchase insurance as early in the process as possible. If you procrastinate, you may miss out on certain benefits.

How late can you add travel insurance?

Technically, you can buy travel insurance at any point -–even when you’re already traveling. However, the policy and the amount of coverage available will be more limited the longer you wait. The only time coverage becomes impossible is when an “unforeseen circumstance” becomes foreseen or evident.

Can I get travel insurance in a day?

Any insurance plan takes a few days to come into effect. Buying the protection plan at the last-minute means you will be travelling uninsured till your policy gets into effect. This might also lead to insurance companies rejecting your claim. Most often, you lose your cover for cancellation costs.